Optical modules are one of the most fundamental and important core devices in optical communication. In the 20 years of rapid development of China’s communications industry, several major development opportunities have also contributed to the rapid growth of China’s optical module industry from scratch.

Multiple opportunities to promote the development of optical modules:

The first opportunity appeared around 2001, and the split of China Telecom formed a situation in which many operators coexisted. In order to be in a favorable position in the competition, everyone began to build a DWDM dense wavelength division multiplexing system based on 10Gbit/s rate at the backbone level. Although the optical modules were still dominated by foreign products at the time, there are already many optical module companies in China that are producing low-rate modules.

The second opportunity appeared around 2007. The rapid development of 3G mobile communication makes communication between people not only limited to voice and SMS, but also the urgent need for traffic. At the backbone level, operators need to upgrade their original 10Gbit/s DWDM systems to 40Gbit/s DWDM/OTN systems, which also creates huge demand for higher-speed optical modules.

The third opportunity began in 2012, the rise of data centers, the construction of large-scale 4G networks, and the mobile backhaul network began to transform from the TDM time division multiplexing technology adopted by 3G networks to the PTN/IPRAN network based on packet technology. The service type adds video traffic to the traffic killer based on 3G, forcing the backbone network rate from 40 Gbit/s to 100 Gbit/s, which in turn leads to the demand for higher rate optical modules.

Now that the industry is at the beginning of the fourth opportunity, 5G networks, ultra-high-speed interconnected data centers, communication clouds, etc. are emerging one after another, and the optical module field is ushered in a new spring.

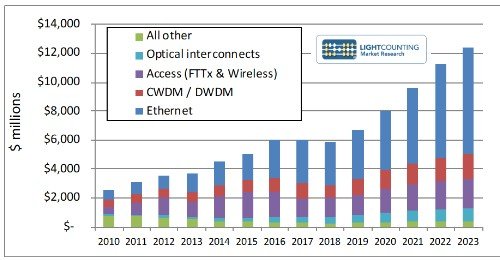

It is estimated that by 2023, the optical module market will exceed $12 billion.

In October 2018, the well-known consulting organization LightCounting released statistics and forecasts on the overall market size of optical modules in recent years. As can be seen from Figure 1, by 2023, the overall size of the optical module market will reach more than $12 billion, double the $6 billion in 2018. It can be seen from the measured data that the two key applications of 5G (wireless access) and data center (Ethernet) will push the optical module market to a larger scale.

Figure 1 Status and forecast of the overall scale of the optical module market

in recent years and in the next few years

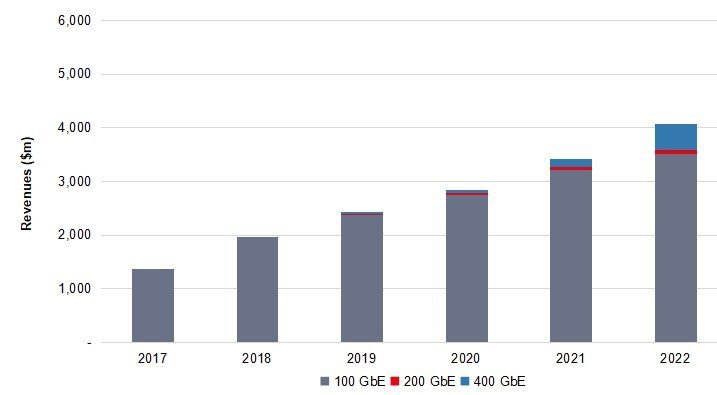

Another well-known forecasting agency, Ovum, also gave the latest forecast results for the data center’s 100Gbit/s and higher-speed optical transceiver module market, as shown in Figure 2. As can be seen from Figure 2, by 2023, the data center optical module will be dominated by 100GbE and 400GbE, with a small amount of 200GbE demand, and the overall market size will reach about 4.8 billion US dollars.

Figure 2 Ovum data center optical module market sales forecast

To Sum Up

According to industry statistics, China’s optical module market revenue in 2011 was only about 950 million US dollars, accounting for 31.15% of the global optical module market; in 2015, China’s optical module market revenue has grown to 1.62 billion US dollars, in the global light The proportion of the module market also rose to 35.06%. It is estimated that by 2020, the domestic optical module market revenue will reach 2.68 billion US dollars, and the proportion in the global optical module market will also rise to 37.75%.

China’s optical module industry has provided low-speed low-end products from the beginning. Now it has become the world’s largest market for optical communications under the efforts of China’s investment in technology research and development and independent innovation. With the arrival of 5G, China’s optical module market will surely usher in a better tomorrow.