After China National Holiday in 2022, many hardware factories started less than 50% of the work, with only 20~30% of orders in the last two years.

KEY2OPTICS.COM in October 25th

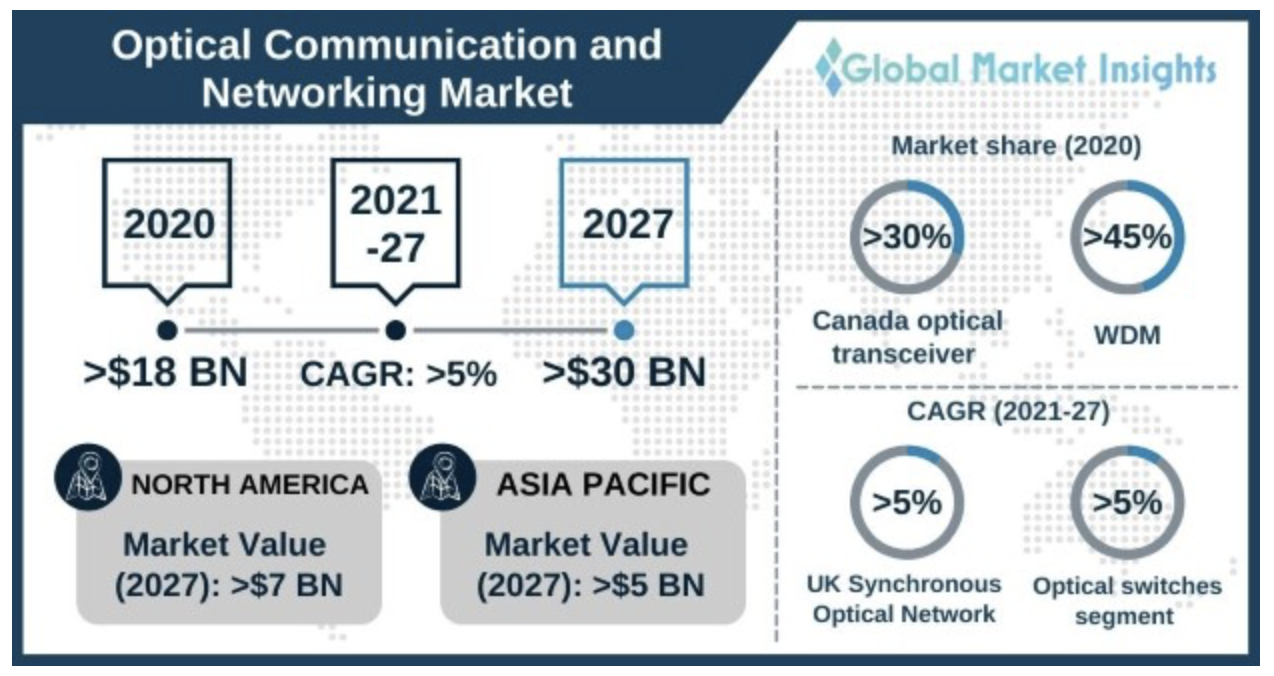

Global Optical Network Market Background

In the past three years, with the impact of COVID-19, demand in the broadband access market is continuing to increase, and benefiting from this, the optical network market has maintained a relatively good growth rate.

According to statistical data from Global Market Insights, the optical communication market will have total sales of US$18 billion in 2020, and then grow at a CAGR of around 5% per year, with total sales expected to reach US$19.8 billion in 2022, and market will reach US$30 billion in 2027.

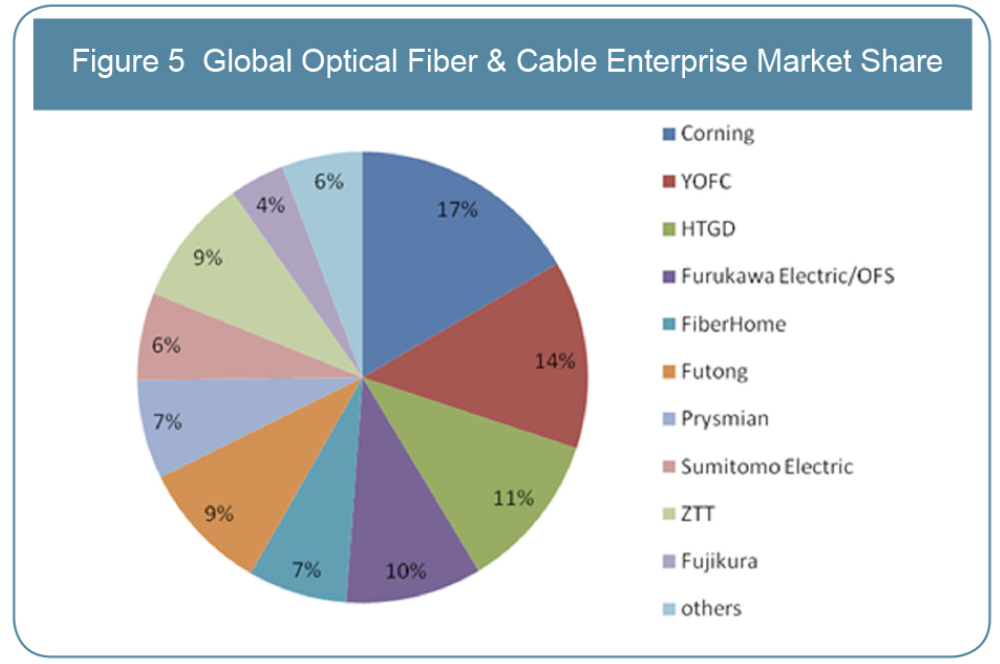

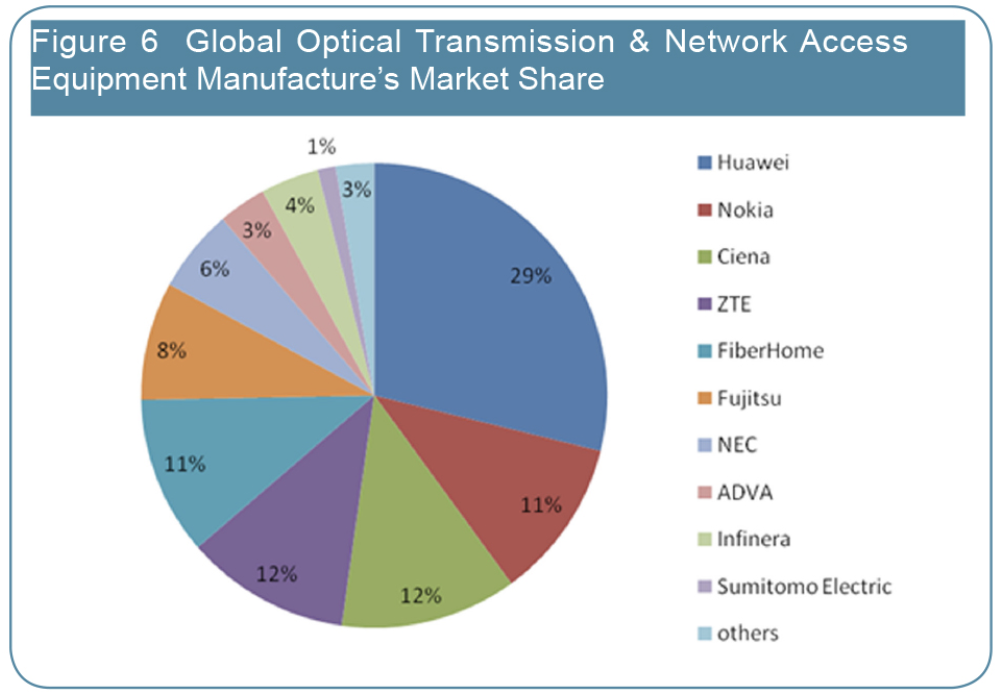

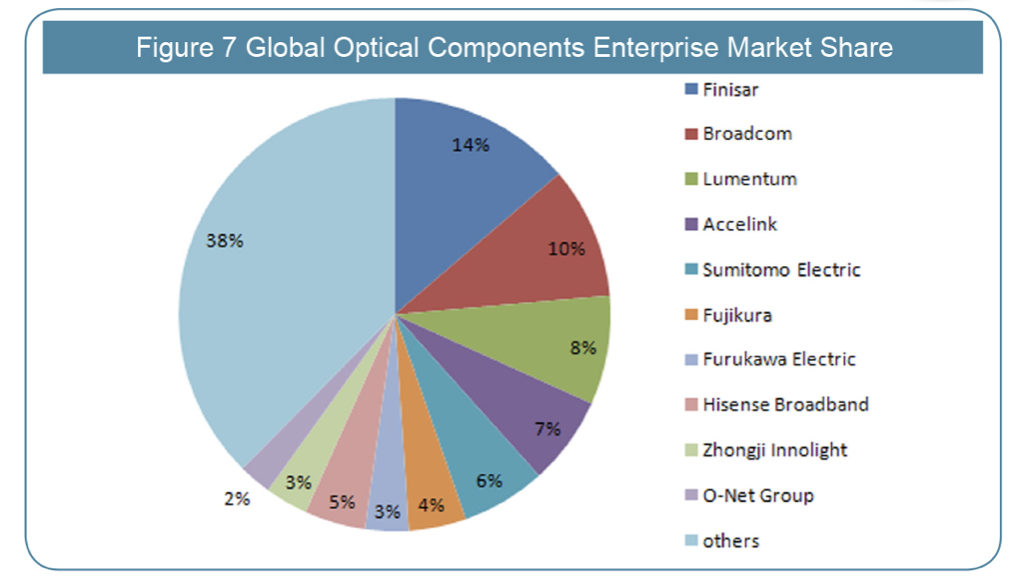

China, as one of the major producers of global optical network hardware, accounts for more than 50% of the market share of optical fiber and cable, more than 52% of optical network equipment, and more than 17% of optical components, which make it played an essential role in the global optical network market. (Stats from the 2018 report of NetworkTelecom.cn)

However, in the third quarter of this year, Huawei and ZTE, the head company of the industry in China, and many small and medium-sized enterprises, whose orders and shipments are sharply reduced compared to the same period in previous years. Huawei president, Ren Zheng Fei even spoke in an internal meeting, “The winter of the communications industry is coming.” Is that warning before the crisis, or just concern for the industry’s future? We contacted several Chinese manufacturers of optical network equipment to find out the real situation of this industry.

The ‘cold’ season is real, many companies started less than 50% of the work

At the beginning of May 2022, with the impact of the Russian-Ukrainian war, the demand for European customers drop-off suddenly, and some companies reveal less intention for WDM equipment, which is the main product for the optical transport network; and for the optical connector and adaptor, which are widely consumed for the projects, most orders are delayed and even canceled.

The traditional production off-season of the optical network industry emerges every July and August, and it is not surprising that it’s suddenly ushered in the peak season in September. However, this September, the decline in demand is even more obvious than in the last two months, some factories said their product shipments turned halved month by month. At this point, we began to realize the real ‘cold’ season is coming.

The first week of October is China’s National Day holiday, in previous years, after the holiday, most companies had to work overtime to deliver the pile of orders; however, after this holiday, many companies complained that the orders for this month were only 25% to 50% of the average monthly amount in the first half of 2022.

Let’s find some typical examples:

GPON

In the access network market, the XGS PON module (What is XGS PON?) is considered a high-interest rate guarantee for the project, also see a decline sign for the market demand; a predictable impact by the European market, at least 2 million optical modules requirements are delayed.

The major raw material manufacturers, such as BOSA (What is BOSA?), several manufacturers said: GPON BOSA shipments are reduced month by month. While the good thing is that there are still great China domestic project requirements for Gigabit network upgrading this year, however, the demand for next year will not be such optimistic.

Optical Connectors and Adaptors

A adaptor manufacturer from Zhejiang said they got ‘cold’ for the entire season, the requirements were halved since July, and in recent two months only a 20% start rate to last year, and no raise-up signs in October.

PLC Fiber Splitter

A number of PLC fiber splitter manufacturers said the recent quarter start rate can only maintain about 40% of the total. The market falls into a price dumping situation: the largest amount of plug-type splitters exploded to an extremely low price, plus the cost of the raw material is increasing, e.g. the ceramic plugs cost is nearly half of the product, the benefit is much lower than before, nevertheless, even if in such low costs the market demand is still raised.

CWDM & DWDM

CWDM devices are the mainstream of the 5G network in China and some Asian countries.

With the great need for 5G network infrastructure, CWDM is massively required for the last three years; in 2022, it is still in the top three devices for 5G projects, however, “we have only seen bids but no actual shipments.” this is confirmation from a CWDM vendor from China. We can’t help to speculate whether the remaining inventory, which comes from the high demand wave in 2020, has not been cleared yet.

DWDM demand comes more from Europe and North America; we also have to consider: with the current global conflict situation, will the telecom operators still keep the enthusiasm for new construction of wireless networks?

Still, there are some news look not that bad

Optical Chip – A Milestone for China

China optical chip vendors’ orders continue to climb. 2022 is probably the year of China’s DFB/PD chips (what is DFB?) milestone, our survey found that Chinese chips are becoming the mainstream solution for optical network products nowadays, such as optical transceivers esp. in the DFB chip market, for both access networks and data centers. This is a great achievement in both qualitative and quantitative leaps for China’s chip industry (Report from LightCounting).

Optical Transceivers/Optical Modules – Stable Market

The key players of optical transceivers in China act quite peacefully this year, with no sudden breakout or drop-off in production, “Our orders are relatively stable this year.” the sourcing manager from Smart IoT Shenzhen (Key2optics’ parent company) Mr. Wu told us. We also study, the sales of the Optical Transceivers market in China, 80% of sales come from 10G/25G transmission networks, 9% of sales come from 100G long-distance transmission networks, and others share the rest.

Fiber Optic Cable

Fiber optic cable manufacturers are insensitive to the off-season, generally, look at the market outside of China, mainly distributed in Southeast Asia, West Asia, and some parts of Europe, where the outdoor fiber optic cable demand remains high for years.

Reason: The Demand is much less than Expected in Global Economic Downturn

The data center market, which is a growing market for years, has seen a sharp 20% drop in demand from large players like Google and Meta. As well, the expectation for the fourth quarter of the data center market is still not optimistic. The reason behind the decrease is that the global economy is in a downturn cycle, and the confidence in economic recovery is mere, so the expense for those markets are strictly controlled.

No coincidence, a friend from a US company remind me of their budget this year, “The winter is coming, we are cutting all costs, and postponed all recruitment, even the marketing expense are compressed, like traveling and advertising.”

Summary: Threats not Crisis

The current global economic recovery is sluggish, and international geopolitical conflicts are more frequent than ever. The “De-globalization” wave and concept bring more uncertainty and instability for the economy, there is indeed a certain risk of demand. However, the goal of global digitalization and new technology transformation remains unchanged. Therefore, the demand for the broadband access market will still be upward, while the construction cycle of new data centers may be lengthened but not be ceased.

Looking ahead to the last two months of 2022, it is usually the traditional peak season (prepare inventory for next year) of the industry, and 2023’s budgets of operators will also be revealed in the fourth quarter. The preparation period may be delayed this year, but it will definitely come.

Opportunities in 2023

The biggest opportunities in China market probably lie in three areas:

- The construction of a new metropolitan network, which comes from the Chinese New Policy requirement ‘Dong Shu Xi Suan’ (Build Data Centers in the West, to empower the Algorithmic Ability in The East)

- New business pattern upgrade of three telecom carriers in China, all the business will be shifted to the cloud

- 5G network expansion continues in 2023, and some unfinished projects are still pending and will be delivered in the next few years

Opportunities for the global market will focus on North America in 2023, the United States is engaged for more infrastructure next year, such as building more 5G networks and upgrading the existing optical transport networks, and the demands will remain strong for at least 2~3 years.

All Rights Reserved Key2optics.com

Mail: [email protected] Tel: +86 137 1427 7453(WhatsApp)